child tax credit number

Similarly any children using an ITIN instead of a Social Security number cant be taken into account when an otherwise qualified individual claims the credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

44 2890 538 192.

. Making a new claim for Child Tax Credit. 2021 Child Tax Credit payments are made to eligible parents and guardians based on the number of qualifying children they have. The amount of credit you receive is based.

Advance Child Tax Credit. Here is some important information to understand about this years Child Tax Credit. Or an IRS Individual.

Only available if you arent required to file a. Here are some numbers to know before claiming the child tax credit or the credit for other dependents. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

You may be able to claim the credit even if you dont normally file a tax return. The maximum amount of the child tax credit per qualifying child. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for.

The Child Tax Credit is designed for low to moderate income families raising children. Request for Transcript of Tax Return Form W-4. Already claiming Child Tax Credit.

This option is a good choice for people with lower incomes who want a quick and easy way to claim the Child Tax Credit and stimulus payments. Dial 18001 then 0345 300 3900. Employees Withholding Certificate.

Starting with Tax Year 2022 eligible New Jersey residents can claim a refundable Child Tax Credit on their New Jersey Resident Income Tax. To reconcile advance payments on. The Child Tax Credit provides money to support American families.

Overview The American Rescue Plans expansion of the Child Tax Credit will reduced child poverty by 1 supplementing the earnings of families receiving the tax credit and 2 making. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Payment amounts for each qualifying child depend on the.

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. For 2021 eligible parents or guardians can. The amount you can get depends on how many children youve got and whether youre.

This child tax credit contact service number 0843 902 1827 is totally unique for addressing the consumer service experts obtainable in the little one tax credits customer care department. In addition to missing out on monthly Child Tax Credit payments in 2021 a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed. Make sure you have the following information.

The Child Tax Credit helps families with qualifying children get a tax break. 1 day agoThe American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6. You can also use Relay UK if you cannot hear or speak on the phone.

A childs age determines the amount. Telephone agents for the following benefits and credits are available. It has brought significant economic relief to the largest number of working families in the history of.

Child Tax Credit. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment.

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

What Is The Child Tax Credit And How Much Of It Is Refundable

Where Are The Most Child Tax Credits Claimed Tax Foundation

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

Child Tax Credit Form Fill Online Printable Fillable Blank Pdffiller

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2021 Changes Grass Roots Taxes

The Child Care Tax Credit Is A Good Claim On 2020 Taxes Even Better For 2021 Returns Don T Mess With Taxes

Irs Failed To Send Child Tax Credit To Millions Audit Ktla

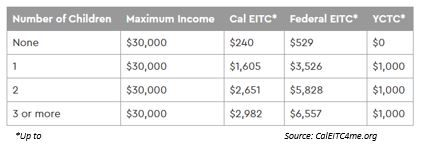

New Young Child Tax Credit Higher Income Limits Among Highlights Of This Year S California Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

/cloudfront-us-east-1.images.arcpublishing.com/gray/7XVLE5VWLVDV5I36374YHUTMN4.jpg)

Madison Co Accountant Gives Advice On Child Tax Credits

Will You Have To Repay The Advanced Child Tax Credit Payments

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

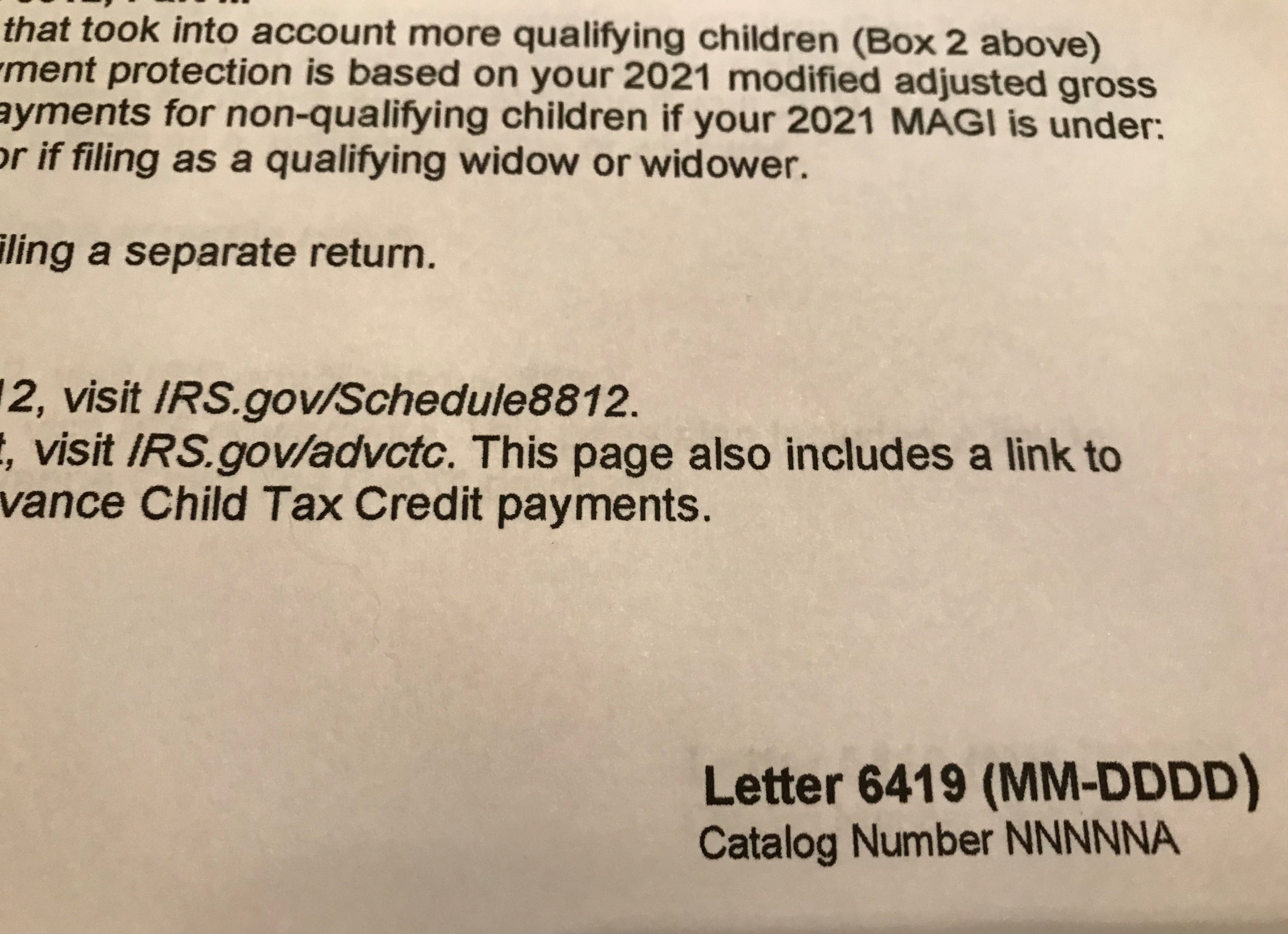

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

When Parents Can Expect Their Next Child Tax Credit Payment

Advance Child Tax Credit Payments To Begin This Week News Talk Wbap Am